Artificial Intelligence has captured the imagination of many. It will be the next revolution in Finance.

In the first wave we saw innovations in computer technology drive the shift in money from active mutual funds to index funds.

In the second wave, we will see the active fund managers fight back. Pivotal in this will be the use of carefully tailored AI technology.

What we do

We are a fintech startup with the mission to help fund managers creating the next generation of mutual funds, powered by AI.

It is well known that over 90% of active mutual funds underperform their benchmark after fees. Furthermore, the 10% that outperforms, will mostly likely not persist in doing it, according to S&P Dow Jones. As a result, investors have been shifting money to index funds.

Using ArrayStream’s technology, fund providers can re-energise their active funds, and maximise the probability of outperforming their benchmark.

Benefits

All benefits of index funds – low cost, high capacity and long only.

Big Data-Driven – we utilize high-performance cloud computing to process vast amounts of market signals to find those with high predictability.

Polymorphic Diversification – we can achieve more effective diversification with a smaller number of assets. This will not only reduce transaction costs but help you manage ex-ante risks using leading edge techniques.

Technology

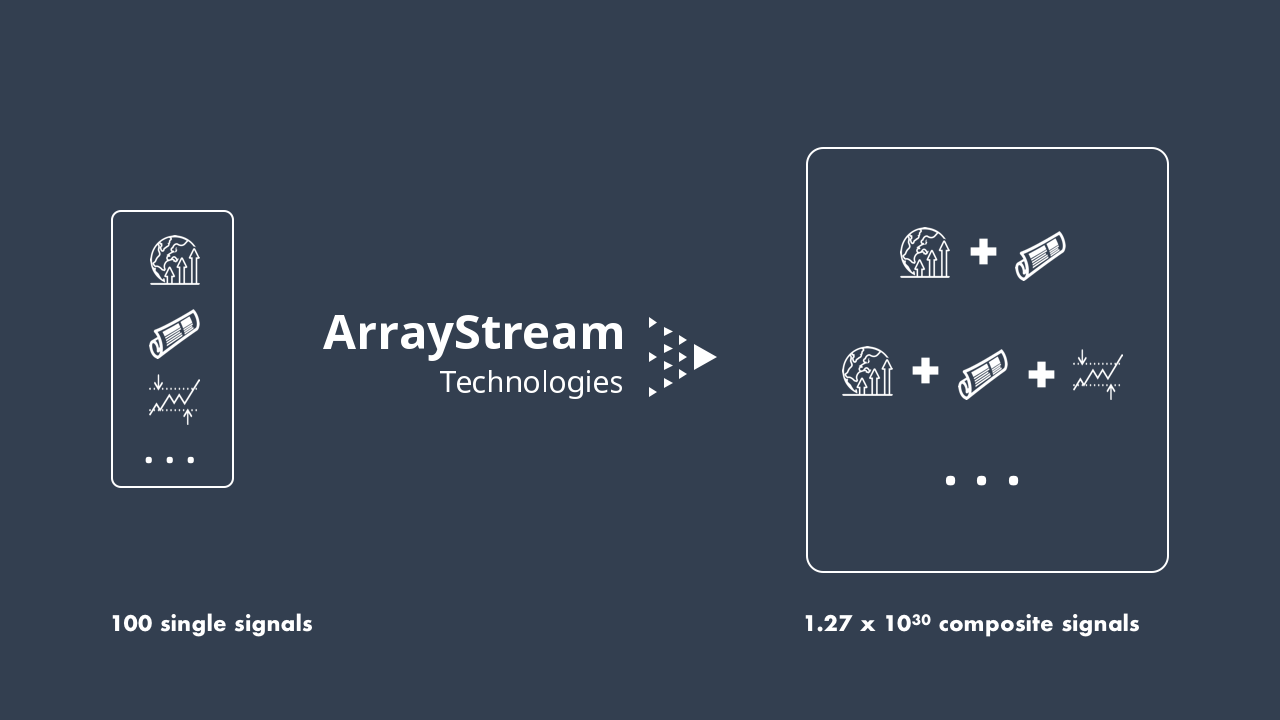

Composite Signals

We create new, composite signals instead of only focusing on single signals. This opens a whole new world of searching for hidden profit opportunities.

We are like hunters who have found forests and forests of new opportunities in the investment space using AI.

Dynamic Signals

Instead of sticking to same signal, we monitor the strength of all signals and switch if they are losing power.

This is the Achilles heel for passive index investing. Passive strategies by definition cannot adapt to new information.

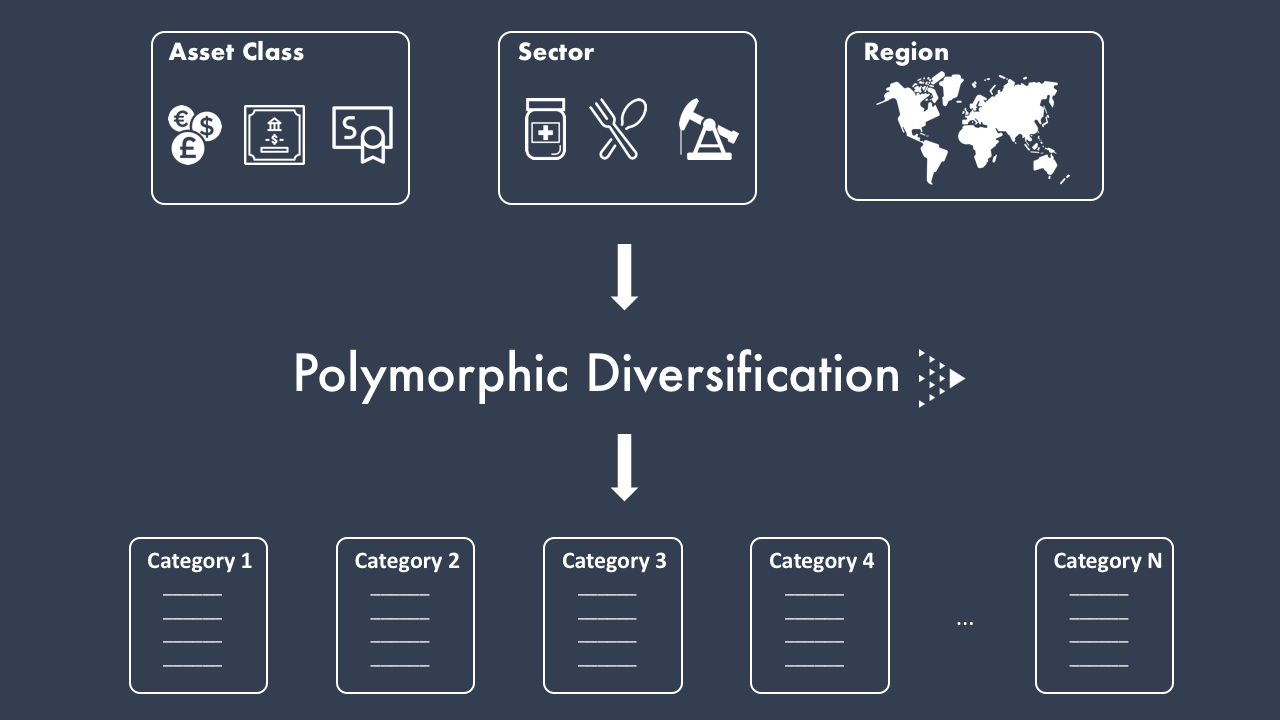

Polymorphic Diversification

For diversification, we don’t just partition our universe by asset class, sector or geography – which is what is done traditionally.

We have introduced a new dimension of diversification: Polymorphic Diversification.